Top 5 Marketing Lessons from China March 2025

March has showcased some key structural developments and consumers shifts of which foreign brands will need to be wary. With the landscape ever evolving, here are some of the top marketing lessons from China, March 2025.

Lesson 1: China’s Vertical Integration Model Eclipsing Western Outsourcing.

Mixue’s ice-cream empire leverages complete supply chain integration.

China’s vertically integrated supply chains are proving to be a formidable advantage over Western outsourcing models, allowing domestic companies to dominate industries ranging from fast food to electric vehicles and robotics. Brands like Mixue, BYD, and Xiaomi showcase how controlling production (or even just having access to it) enables cost savings, efficiency, and speed—posing a significant threat to foreign brands in China and abroad.

Mixue: The Ice Cream Empire Built on Integration

Mixue has revolutionized the franchise business by owning its entire supply chain—growing ingredients, manufacturing equipment, and supplying raw materials to franchisees. While keeping costs low, 97% of Mixue’s revenue comes from selling raw materials and equipment to franchisees, rather than charging hefty franchise fees and making it easier for new stores to open rapidly. This approach has propelled Mixue past global fast-food giants in store count. Unlike Western brands reliant on external suppliers, Mixue’s control over costs and logistics allows it to undercut competitors while maintaining profitability.

BYD and Xiaomi: Winning the EV Race

China’s electric vehicle (EV) industry thrives on supply chain dominance. BYD produces everything from batteries to semiconductors in-house, cutting production costs by 15% compared to Tesla’s Shanghai Gigafactory. Xiaomi leveraged China’s supply chain ecosystem to launch its EV in just three years—something Apple failed to achieve after a decade of trying. This speed and efficiency have helped Chinese brands flood global markets with competitively priced EVs.

The Rise of Robotics

China is set to lead in robotics, with costs projected to drop 70% as domestic manufacturers scale up production. The country’s ability to mass-produce technology, as seen in its EV success, will likely make humanoid robots an everyday reality sooner than in the West. Demographic shifts and a growing elderly population are also driving innovation in the field of robotics, see lesson 2 for more.

China’s production of advanced components and ability to vertically integrate, coupled with the fact that the market is highly receptive to new products and technology, means that it’s going to be very difficult for countries to compete against China in many future product categories.

Key Lessons for Foreign Brands:

Leverage Supply Chain Control – Chinese brands thrive on vertical integration, cutting costs and boosting efficiency. Foreign brands must localise production or streamline logistics to stay competitive.

Move Fast & Adapt – Speed is key in China’s market. Foreign firms need agile strategies, quicker decision-making, and localised innovation to keep up in China.

Differentiate Beyond Price – Competing on cost in China is unsustainable. Foreign brands must focus on branding, storytelling, and premium offerings to stand out and compete against Chinese firms with clear price advantages.

Lesson 2: China’s Aging Population: A Booming Market and Catalyst

China’s population may be shrinking, but its elderly demographic is growing fast. With life expectancy rising from 65 in 1978 to nearly 79 today, the country now has over 310 million retirees. Unlike previous generations, today’s seniors are healthier, wealthier, and more digitally connected—reshaping consumer trends and driving demand for new products and services.

Senior Spending Power

China’s retirees are prioritising health and experiences. From fitness trackers and dietary supplements to premium pet care, they’re willing to spend on quality and well-being. Many are also fuelling China’s travel boom, seeking wellness retreats and historical tourism. For brands, trust and quality assurance are key, as seniors are selective about what they buy and from whom.

The Rise of Senior Influencers

A new wave of elderly influencers is changing perceptions of aging. These vloggers, admired by both peers and younger audiences, showcase an active and fulfilling retirement. Their popularity has created fresh opportunities for brands to engage with both seniors and the younger generation inspired by them. Messaging that emphasises longevity, independence, and intergenerational connection resonates deeply in this space.

The Robotics Revolution

With a shrinking workforce, China is rapidly investing in automation. Robotics, backed by government initiatives and private investments, is expected to follow the success of the EV industry. Bank of America predicts a 70% drop in humanoid robot costs by 2030, making them mainstream in eldercare, retail, and beyond.

For brands, China’s aging population presents both a challenge and an opportunity—those who understand this shift and innovate accordingly will thrive in this evolving market.

Key Lessons for Foreign Brands:

Trust and Quality Drive Senior Consumer Choices

China’s elderly consumers prioritise health, safety, and reliability. Brands must focus on transparency, high-quality assurance, and personalised services to build trust in this selective market.Senior Influencers Are a Powerful Marketing Channel

The rise of elderly influencers presents a unique opportunity for brands to connect with both older and younger audiences. Messaging around longevity, independence, and intergenerational connection can enhance engagement and brand loyalty.Automation and Robotics Will Reshape the Market

With labour shortages growing, China is rapidly embracing robotics in industries like healthcare, retail, and services. Foreign brands should explore automation-driven solutions to stay competitive in this evolving landscape.

Lesson 3: The Power of Chinese Opinion - A Force Brands Can’t Ignore

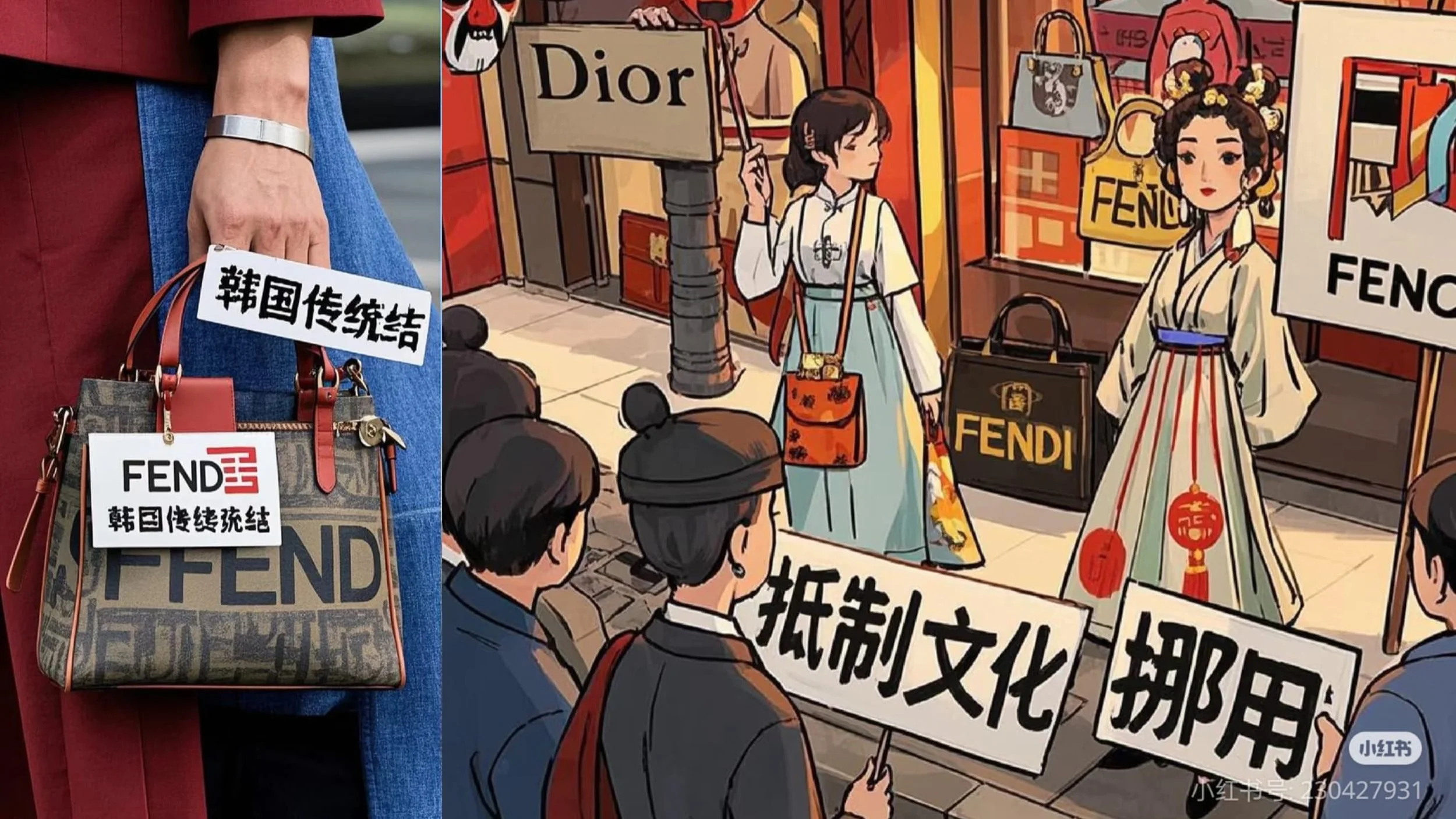

Social media posts taking aim at Fendi mishap. Source: RedNote 艾芯

Chinese consumers wield immense influence, shaping market trends and even pushing back against both foreign brands and government narratives. With social media amplifying their voices, companies and officials alike are finding they must tread carefully to maintain public favour.

Challenging the Narrative

Even with tight online controls, public opinion in China finds ways to make itself heard. Eileen Gu, the US-born Olympic skier who chose to represent China, has been a national darling—until reports surfaced that the government spent $6.6 million on her training. Some netizens began questioning whether foreign-born athletes were worth the investment, leading to widespread debate before the discussion was censored. Similarly, Ne Zha 2, despite its record-breaking success, has faced scrutiny, with online criticisms being suppressed. However, consumers have repurposed film quotes to subtly critique social and economic issues, proving that even entertainment isn’t immune from public discourse.

Luxury Brands on the Defensive

Foreign brands have also felt the heat of Chinese consumer scrutiny. Balenciaga’s ¥2,700 ($373) hairpin went viral—not for its elegance, but for its absurdity, with users mocking its price by comparing it to cheap alternatives on Taobao. Similarly, Fendi faced backlash when it mistakenly attributed a bag design resembling the traditional Chinese Knot to Korean craftsmanship, forcing the brand to remove posts and issue corrections. These incidents highlight how culturally aware—and protective—Chinese consumers have become.

Whether challenging government spending or demanding cultural respect from global brands, Chinese consumers are more vocal than ever, despite China’s infamous censorship regime. Brands must approach the market with authenticity, cultural sensitivity, and an awareness that missteps—intentional or not—can quickly become viral controversies.

Key Takeaways:

Cultural Awareness Is Non-Negotiable

Misrepresenting Chinese heritage, like Fendi’s mishap with the Chinese Knot, can spark backlash. Brands must thoroughly research cultural symbols and narratives to avoid missteps that could alienate local consumers.Pricing Strategies Must Align with Consumer Expectations

Overpricing everyday items, as seen with Balenciaga’s hairpin, can trigger online ridicule rather than exclusivity. Luxury brands should justify premium pricing through craftsmanship, storytelling, or exclusivity rather than shock value.Chinese Consumers Shape Public Discourse—Stay Engaged

Public sentiment can turn quickly, even in a censored environment. Monitoring social media, responding swiftly to concerns, and maintaining transparency help brands stay ahead of potential controversies.

Lesson 4: Beyond Products - Winning Over Chinese Consumers with Experiences

In China’s increasingly sophisticated consumer market, it’s clear that selling a product is no longer enough. Success lies in crafting immersive experiences, fostering emotional connections, and building brand communities.

Take 999 Cold Medicine, which transformed from a pharmaceutical brand into a cultural phenomenon. By co-creating fashion with students and launching charitable initiatives like free hot drink giveaways and coat donation drives, 999 turned consumer engagement into a shared social experience.

Similarly, Budweiser redefined how beer fits into Chinese New Year traditions. Its "Renewal Bottle" campaign turned drinking into a ritual, with peel-off layers revealing auspicious messages. Paired with large-scale countdown parties and social media buzz, Budweiser made opening a beer an act of renewal and celebration.

Heytea, facing price wars in China’s competitive tea market, resisted the discounting trend. Instead, it reinforced its premium image through limited, high-impact collaborations and unique product innovations. The brand’s strategy proves that staying premium isn’t about price—it’s about differentiation and experience.

Retailer Pangdonglai is another standout, elevating grocery shopping with thoughtful details like illuminated shelves, fruit sugar content labels, and staff-first corporate culture. With a 60% revenue surge, it shows that when shopping feels good, people spend more.

Even luxury brands are embracing this shift. Longchamp, instead of banking on exclusivity, builds immersive worlds—like its "Longchamp Vegetable Garden" pop-up in Shanghai. By blending heritage with interactive experiences, the brand connects with Chinese consumers on a deeper level.

The message is clear: In China, brands that prioritise experience, storytelling, and emotional engagement are the ones winning hearts—and wallets.

Key Lesson for Foreign Brands:

Sell Experiences, Not Just Products

Chinese consumers value engagement and immersion. Brands should integrate cultural elements, rituals, and interactive experiences to make their products part of a lifestyle.Build Emotional & Social Connections

Consumers are drawn to brands that foster community and meaning. Initiatives like 999 Cold Medicine’s charity campaigns and Pangdonglai’s thoughtful shopping experience show that authenticity and purpose can drive loyalty and sales.Differentiate Through Innovation, Not Price

Competing on discounts is a losing battle. Instead, brands should focus on unique product features, exclusive collaborations, and premium positioning, as seen with Heytea’s strategy to maintain its upscale appeal.

Lesson 5: China’s Young Travellers Demand Experience-Driven Adventures

Young Chinese netizens experiencing the outdoors on RedNote (小红书) Source: RedNote

Travel in China is undergoing a radical shift, driven by the youth’s desire for unique, authentic, and immersive experiences. Unlike previous generations who prioritised material luxuries, today’s young travellers value outdoor adventures, cultural enrichment, and personalised journeys that align with their social and digital lifestyles.

The Rise of Outdoor and Cultural Exploration

Short suburban getaways, cycling, hiking, and fishing are surging in popularity. In the first week after the 2025 Spring Festival holiday, online searches for cycling gear spiked by 284%, while fishing equipment saw a 93% increase. This shift reflects China’s booming outdoor sports sector, which has grown by 27.1% annually since 2018.

Beyond physical activities, young travellers are seeking deeper cultural engagement. Visits to sites offering intangible cultural heritage experiences have increased fourfold, with revenue from cultural and artistic services jumping 66.3% over the Spring Festival period. First-time travellers—many of them budget-conscious Gen Zers—are gravitating toward winter sports and niche cultural experiences, relying on platforms like Xiaohongshu for peer-driven recommendations.

Government Policies Fuelling Experience-Based Travel

China’s push to enrich consumption experiences is accelerating this trend. Policies supporting tourism diversity, visa relaxations, and expanded flight routes are making outbound travel more accessible. As a result, tourism operators like Tongcheng Travel are prioritising experiential offerings to capture this evolving demand.

Gen Z: The Experience Generation

China’s Gen Z is driving this shift, rejecting inauthenticity and embracing YOLO-inspired adventures. They seek exclusivity, digital engagement, and values-driven tourism, making social media platforms like Douyin essential for shaping their travel decisions. For brands and travel operators, the message is clear: to win China’s young travellers, it’s not just about the destination—it’s about the experience.

Key Lessons for Foreign Brands:

Prioritise Experiences: Young Chinese consumers value experiences over products. Foreign brands should offer immersive, personalised experiences, especially in travel and wellness.

Leverage Social Media: Platforms like Xiaohongshu and Douyin are vital for shaping travel trends. Brands should engage influencers and focus on user-generated content.

Align with Values: Gen Z cares about authenticity and social responsibility. Brands should reflect values like sustainability and inclusivity to build loyalty.