Guideline: Xiaohongshu/RED sees media spend growth, Douyin drops

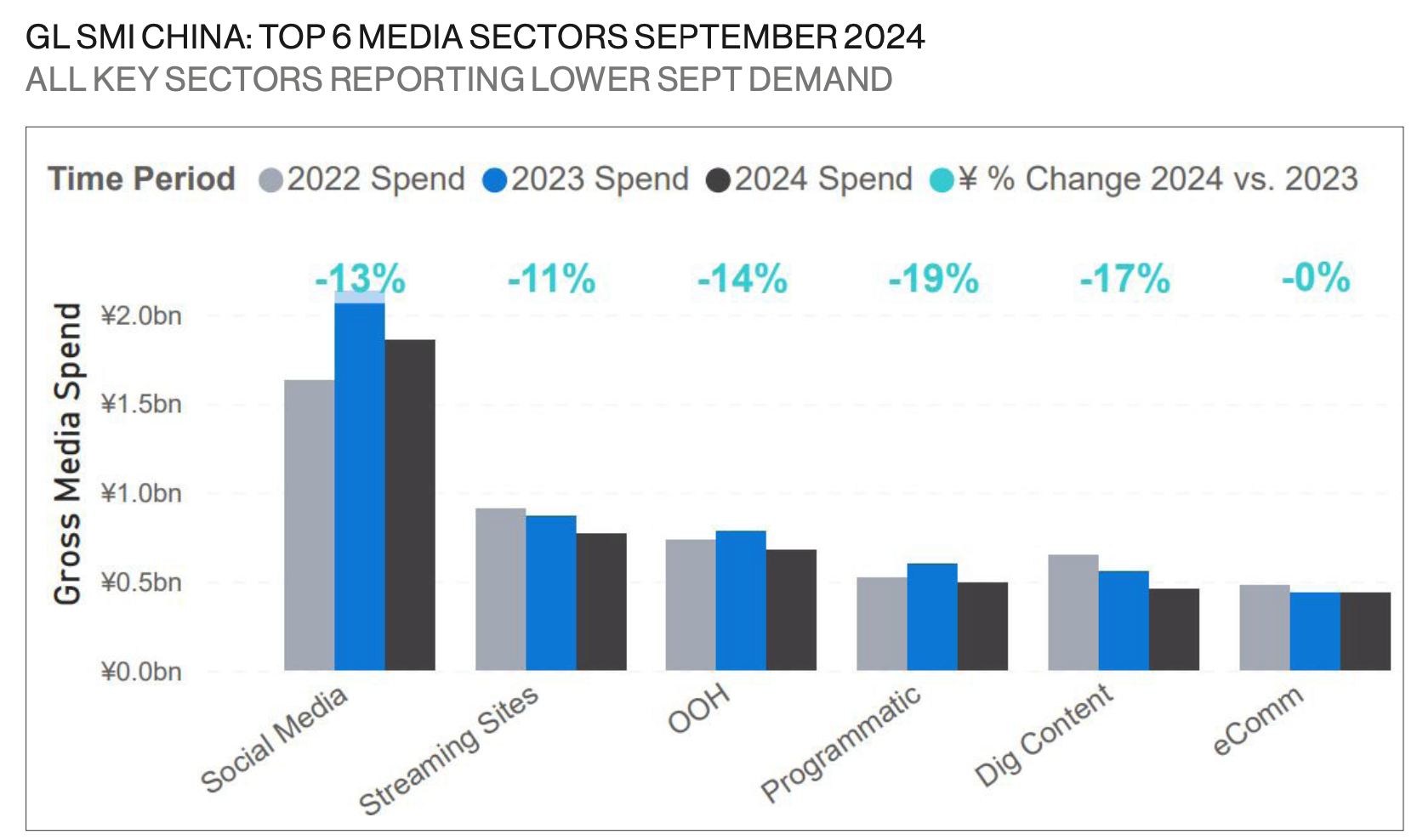

Digital channels continue to dominate media spend from brands in China, but even these platforms have been hit by overall softening ad spend which dropped 17.7% year-on-year in September to ¥5.19 billion ($730m) according to Guideline SMI data, which tracks market media expenditure trends across global markets including China.

E-commerce was the only channel not to see a drop in ad spend, whereas Programmatic spend has the largest drop at 19%. Digital content, OOH, social media and streaming sites were all recipients of double-digit drops in ad spend.

Spending across all of the main online platforms dropped, with the exception of RED which grew 43%. ByteDance of Douyin fame remains the largest area of ad spend, but saw the largest drop of 27%. After running hot, brands are increasingly questioning the ROI of the platform, although many could be working smarter with their Douyin spend. The drop in spending has had little impact on 41-year old co-founder Zhang Yiming, who was crowned China’s richest man last month.

Across the highest-spending categories, Consumer Electronics was the only category spending more than a year ago, up 36%. While the top-spending category, Beauty, Grooming & Personal Care saw the largest drop, tanking 35% since September 2023.

September was the last month not to be impacted by Beijing’s stimulus package, so we will watch with interest on any impacts on ad spend following this.