Facial Recognition for Chinese Consumers: Think Mobile Payments Scale

Jump ahead a few quarters into 2019 when an athletic lady in her mid-30s walks into a sports store. "Welcome back Mrs. Zhou, how can I can help you today?" asks the smiling clerk named Xiaoyu. Zhou is impressed, she has only ever been in the store once before, and that was six months ago, but Xiaoyu remembers her name and greets her like family. "I'm looking for a new pair of running shoes," says Zhou glancing at her feet. Xiaoyu nods, "I'm not surprised. You'd said the last pair were for the Wuxi marathon, so I'm guessing you've run many miles since January. Will you be going with Nikes again? We'd found them best suited to your running style last time." Wow, thinks Zhou, this store is always busy, they must get thousands of customers every week, yet Xiaoyu is treating me like I'm their most important customer.

After selling her a snug-fitting pair of kicks, Xiaoyu convinces Zhou to upgrade the smartwatch she purchased in January, and buy arms-full of clothing and accessories for her son who joined her on the last visit. Xiaoyu notices Zhou looking nervously at the towering pile of purchases on the counter, "Don't sweat Mrs. Zhou, you don't have to carry it all. We have your address on file and will deliver it to your home before lunchtime, free of charge."

Although Zhou spent a lot more than she'd planned to, she skips out of the store humming from the experience. She's just joined the store's loyalty program and followed their social and ecommerce accounts, sharing the encounter with her runners group on WeChat.

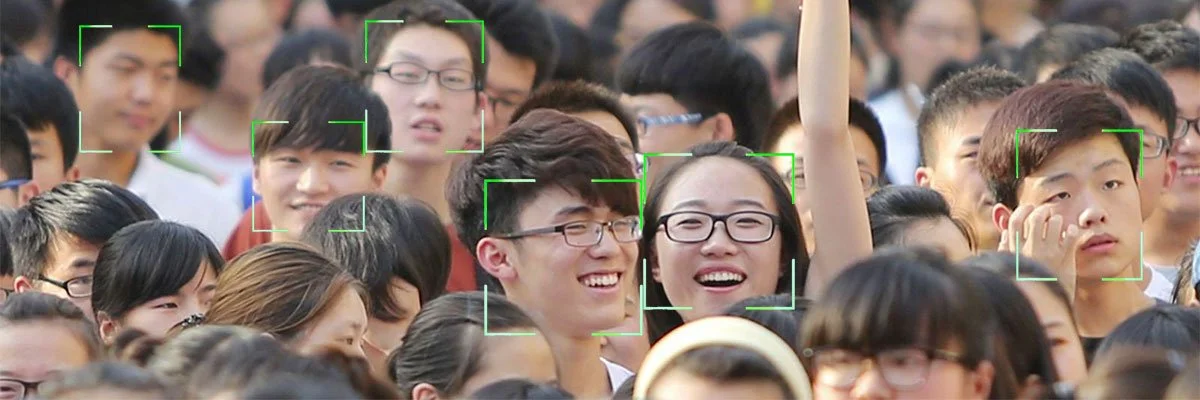

Mrs. Zhou's experience is likely to become more and more common in China this year. This is due to one of the big trends in China - facial recognition - which will see adoption accelerating this year. Most facial recognition coverage in China is about control and monitoring, such as travelling by plane, crossing the street at the right time, or using the correct rations of loo paper. Yet there are increasing marketing applications that take convenience, personalisation and customer service to a new level.

We expect the slew of helpful facial recognition applications will attract a critical mass of users, seeing it integrated on countless platforms - much like mobile payments have been in China. In just the past month there are been a couple of examples: Alibaba is allowing China's millions of small and mid-sized retailers accept face-scan payments through a simple tablet application and China's Airbnb Xiaozhu is rolling out a trial allowing facial recognition-enabled smart door locks for guests. These and other applications will vastly improve the consumer experience and drive adoption.

Facial recognition technology is still in its infancy, so teething issues are to be expected. Last November, a facial recognition camera caught a top businesswoman "jaywalking" mistakingly scanning her face from an advertisement on the side of a bus. The mixup came less than a month after China's State Administration for Market Regulation warned consumers about facial recognition door locks, some which can be easily fooled by photos of faces and 3D-face modelling. Nevertheless the technology is continuing to improve, with China leading the way. It took the top-5 spots in the US National Institute of Standards and Technology facial recognition vendor test late last year, with the winner YITU achieving an accuracy rate over 99%.

The year ahead will be an interesting one with the slowing economy and uncertainty around a March 1 resolution of the Trade War. Yet, in line with previous years, consumption is expected to remain the key pillar in China's continued ascent driving two thirds of total economic growth. As ever, the shining prize of China's massive consumer market will bring forth plenty of marketing innovations such as facial recognition, allowing brands to stand out and connect with customers like never before. China Skinny can assist your brand to ensure that you are leading the pack.

Here are this week's news and highlights for China:

Chinese Consumers

China Pledges More Stimulus in 2019 as Economy Seeks Bottom: China’s top policy makers have confirmed that more monetary and fiscal support, with "significant" cuts to taxes and fees will be rolled out in 2019. The focus for macro policy has shifted from lowering long-term risks to boosting short-term demand.

China's Consumption Market to Maintain Stable Growth in 2019: Beijing expects consumption to contribute to 65% of economic growth in 2019, with an expected 9% increase in total retail sales of consumer goods. In the first 11-months of 2018, retail grew 9.1% contributing 78% of total GDP growth. The three-day New Year holiday saw Beijing retail sales grow 6.3% year-on-year and Shanghai grow 10.6%. China's service industry was the star performer in December, accelerating to a six-month high according to PMI measures.

Chinese Consumers Becoming More Discerning: First-tier city consumers tend to be rational shoppers and are more sensitive to pricing, but lower-tier cities’ consumers are upgrading their shopping choices and moving to premium brands. However, first-tier city consumers still remain skeptical about the quality of local brands according to a report from Nielsen and Vipshop.

From Peppa Pig to Giant Babies, These Memes Took Over China’s Internet in 2018: Despite the ever-tightening environment for free speech, Chinese people still found creative ways to express their anger and criticisms over societal problems, such as sexual harassment, and “giant babies” whose selfishness can sometimes lead to disaster.

China’s Population Could Start Shrinking in 8 Years: The removal of China's one-child policy has done little to motivate would-be parents with 17.23 million children born in 2017, down from 18.46 million in 2016. Estimates for 2018 stand between 15-17 million. China's massive supply of labour that helped power its rapid economic growth could be 200 million less by 2050, hence the investment in robots and AI.

Digital China

The Year in China Tech in Five Simple Graphics: The big quotes of last year from China's tech royalty, tough times for gaming, the opposite for short video, smartphones are finally getting weird again, and facial recognition.

What is Tmall & Taobao Influencer Marketing?: 60-70% of Tmall and Taobao’s mobile apps focus on content, including short-video, live streaming video, photos, and more. More than 1.6 million content creators took away nearly ¥3 billion ($437,000) in commission on Alibaba's related platforms including Taobao Headlines, Weitao, Taobao’s flash sale platform (Tao Qianggou), “good goods,” “love shopping,” “must-buy list,” Taobao Live, Tmall Live, “fashion big shots,” My Tao My Home, “shopping the world,” “affordable goods,” “trendy cool play,” “life research institute,” “convenience store” and more.

It’s More Than Just the Trade War. Apple’s China Business has Been Under Pressure for a While: Tim Cook has blamed China's economic deceleration for the Apple's poor performance, yet the iPhone has lost its aspirational appeal with its unjustified high pricing versus feature-rich local competitors such as Huawei, Oppo and Vivo for many consumers.

China Resumes Video Game Approvals After a Nine-Month Regulatory Freeze: 67 mobile games, six PC titles, and one console game gained recent approval and will shortly receive permission to publish and run their games in China, however Tencent and NetEase were notably absent from the first round of approvals.

Food & Beverage

China’s Loss-Making Luckin Coffee Start-Up Doubles Down on Subsidies to Win Customers from Starbucks: $2.2 billion-valued Luckin aims to become China’s biggest coffee chain brand by the year end, surpassing Starbucks by cups of coffee sold and number of shops. It plans to add 2,500 new stores to its current 2,000 stores this year and will continue to give subsidies, with profitability not a focus at this point. The chain is estimated to have more than 12 million customers who've bought nearly 90 million cups of coffee as of December.

Inside the 2018/19 Cherries from Chile Promotional Campaign: Chile's exports of fresh cherries to China almost tripled between the 2016/7 and 2017/18 season, accounting for 85% of its exports. This year it is ramping up even further in China, with a host of initiatives spanning refreshment vans, to ads on mega LEDs in 15 cities, to advertising on 16 different apps.

'The Perfect Crime': Aussie Business Battles Counterfeit Wine in China: Following the discovery of 14,000 bottles of fake Penfolds wine for sale in China in November, Wine Australia had to concede it can't keep track of the extent that counterfeit Australian wine is being sold in the country. Some wine products in China are estimated to be 50% counterfeit. QR codes are increasingly popular in China and many Chinese consumers expect to see QR codes on wine bottles.

Chinese Tourists

Chinese Home Sharing Site Xiaozhu to Roll Out Facial Recognition-Enabled Smart Locks in Chengdu Pilot Scheme: China's Airbnb Xiaozhu, plans to step up the introduction of facial recognition-enabled smart door locks for guests for 80% of listings in Chengdu - its second largest market - as part of a broader effort to improve safety and security. A few years ago there were concerns about Chinese people not wanting to share their homes with strangers; in 2017, 78 million people, both hosts and guests, were involved in China’s home-sharing business in 2017, creating a market worth ¥14.5 billion ($2.1 billion). Apartments will also be equipped with noise detectors letting guests know when they are being too loud.

Luxury

Canada Goose Stock Soars as Chinese Shoppers Flock to Beijing Store: Canada Goose shares dropped nearly 40% amid concerns on Sino-Canadian relations following the Huawei CFO arrest in Vancouver in December, but the overwhelming success of its first store launch in China which saw droves of consumers line up for $1,300 jackets has seen shares rise again.

That’s the Skinny for the week! See previous newsletters here. Contact China Skinny for marketing strategy, research and digital advice and implementation.