Consumer Research.

Whether you’re here for light social listening, qualitative exploration or product testing, China Skinny has you covered.

Online Listening

Consumer research starts with a foundational analysis of online behaviour, i.e. what are they posting and reading online, what are the purchasing on e-commerce and what kind of reviews are being left, what people are searching for etc.

Alongside our expertise in the market, findings are then distilled into key insights which are then explored or validated in further phases of consumer research.

That stage involves:

social media listening

based on key topics across all platforms of interest: content, reviews, hashtags, searches, post numbers, key influencers etc.

trend analysis

search analytics

e-commerce reviews

Direct Consumer Engagement

The most valuable insights come straight from the horse’s mouth, for which we utilise a range of tools and techniques to tackle your objectives. Some of our key processes include:

pre-engagement

focus groups

qualitative

quantitative

product testing

However, when it comes to engaging with consumers, their responses are heavily influenced by their cultural background and our approach towards them. This gauntlet is all the more difficult to navigate in China, but at ChinaSkinny we know what works and what doesn’t to get authentic answers from consumers.

Qualitative Techniques

Chinese consumers are notoriously concerned with face-saving which can influence the results of qualitative processes. This is why for pre-engagement (mobile engagement we conduct pre-focus groups or interviews), focus groups or qualitative interviews we employ various projective techniques to uncover authentic responses of our responses. Some include:

Simple associations (for example, “when you see xx, what comes to mind?“)

Benefit ladders (repeat questions digging down to the core drivers behind certain decision or perceptions)

Obituaries (we get respondents to imagine they are deprived of a product, brand or category to get to their most visceral reactions)

To learn more about our techniques and how they can help you get in touch with us here.

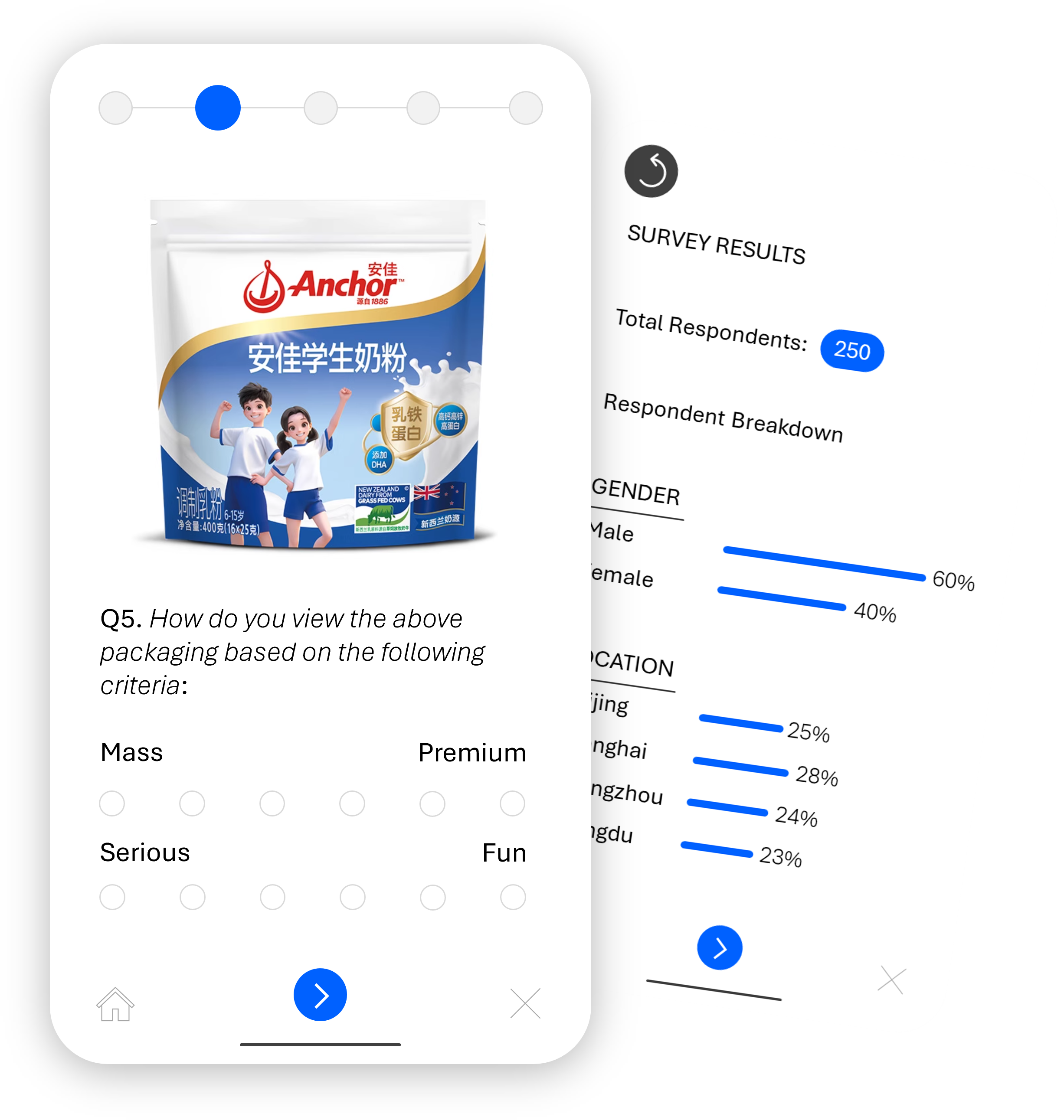

Quantitative Techniques

When it comes to engaging with consumers via a survey, it’s important to make the questionnaire and the process engaging in order to get the best response from respondents and reduce respondent fatigue and bias. Furthermore, face can still play a role in what and how Chinese consumers feel comfortable responding, thus the wording and approach can be very different to a survey conducted in the West. Some of our techniques include:

Semantic differentials: measure respondents perceptions across a semantic spectrum (i.e. formal to informal, happy to sad etc.).

Price sensitivity: we use various techniques including Van Westendorp and Gabor-Granger depending on the context and objectives of the project.

Pairwise: asking respondents “this or that“ which is a great way to break down lists of options into head-to-head votes, reducing cognitive overload.

To learn more about the techniques we use and how they could tackle your China objective, then get in touch with us here.