New data highlights the disparities between China’s media mix and other markets

If you needed further evidence about how different the Chinese media market is from others, look no further than Guideline SMI’s new China ad demand data. The advertising intelligence and media planning company has consolidated data from the big advertising agencies in China, providing some interesting comparisons and longitudinal tracking of spending across media platforms in the market.

A comparison with other geographies illustrates the stark differences between China and markets like the US, UK, Canada, Australia and New Zealand.

One of the biggest disparities is the small part that television advertising plays in the media mix in China. In the US, television accounts for 29.8% of ad revenue, with the UK, Canada, Australia and NZ all around the mid-late 20% mark. Whereas TV advertising in China, where all networks are controlled by the state, accounts for just 3.1% of spend.

On the other hand, digital advertising accounts for 81.9% of ad spend in China, almost double that of Australia and NZ, and around 20 percentage points higher than the US and Canada.

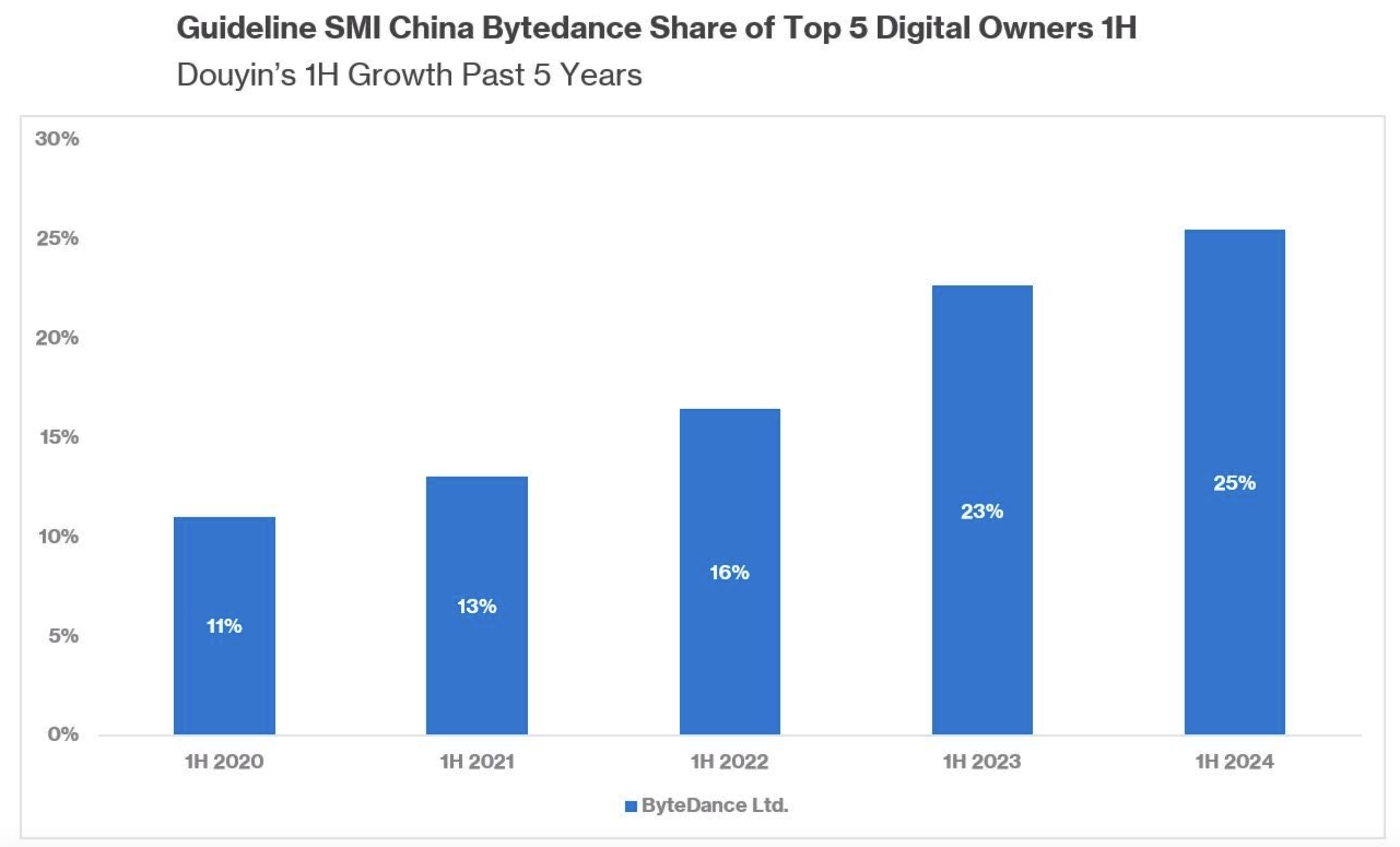

Douyin’s rise in prominence is clear, illustrated by shifts in ad spending, rising from 16% to 25% of digital ad spending in just two years.

Social Media gained the largest share of ad spend across all media sectors, at 40.5%. It continues to grow with the value of ad spend to Social Platforms 7.4% up in the first seven months of this year, while bookings to Social Video sites increased 12.7%.

Of the non-digital channels, the one to watch in China is Out of Home (OOH), which has grown from 46.3% in 2019 to dominate other mediums at 74.3% of spend this year. Many OOH ads are digital in nature and are often closely tied back to digital platforms, further reinforcing the importance of digital in the China marketing mix.

Beauty/Grooming and Clothing/Fashion Accessories are the China ad market’s largest product categories, followed by Consumer Electronics. Beauty/Grooming’s share of ad spend to Social Platforms (such as Xiaohongshu/RED, Weibo and WeChat) dipped 3.4 percentage points in the first half of this year to 29.6%.

“It is wonderful to finally have an accurate, single source, cross media view on media investment trends in China,” says Doug Pearce who leads Guideline SMI’s China operations. “Having definitive month on month, year on year changes can really help with budget setting and media planning.”

Transparent, reliable data can be hard to come by in China. At China Skinny we leave no stone unturned to find the best data sources to assist with our analysis and strategic recommendations. That is why we are chuffed that Guideline SMI is adding China to its line-up of countries to analyse. Things can all be a little less opaque in our China analysis and planning from hereon in.

A mixed bag for category and platform advertising last year, but some clear winners are reflected in the advertising spend

Abstract marketing taps into the audience’s curiosity and creativity, making it a powerful tool for building memorable, distinctive brand narratives in the digital age

A softening ad spend market in China reveals some changes in priorities across online platforms and shifts in spending from major categories

Social media feeds increasing filled with “rough life” posts, alongside the popularity of more authentic retail spaces are just two examples of how Chinese consumers are seeking more real, less polished marketing

China's media market is more complex and fragmented than ever. It is also unique. Digital accounts for a much larger share of spend compared to western markets, and Douyin is increasingly taking a larger share of that. But not every brand is maximising its Douyin investment

China's cross-media ad spend is unlike other markets, as new data reveals. Comparing China to the US, UK, Canada, Australia and NZ highlights stark differences

Have you watched the hit TV series The Tale of Rose that premiered this June? High-quality TV series like these offer a fantastic opportunity for brands to achieve their marketing goals in China. Check it out to see how they help brands make an impact.

At Euro Cup 2024, Chinese brands accounted for five of the 13 top-tier brands, more than any other country. The success of BYD’s sponsorship has been slightly dampened by an adult toy site in the host country of Germany

For about ¥200 ($27.50) a day, you can place your personal ad in some of China's metro stations. Chinese consumers are having a lot of fun with this platform job hunting, celebrating birthdays, proposing to loved ones, and even promoting influencer images…

Brands are exploring new advertising media. From airport luggage conveyor belts, bed sheets hanging on balconies to sewn-in labels, you might be surprised by their creativity.

Chinese household cleaning brand Blue Moon illustrates that even local brands can be very out of touch with the target audience, providing a case study of how not to market and do PR in China

Mother’s Day ads showed how socially attuned brands are to mums, with some great campaigns but also some woefully inappropriate

These CNY marketing campaigns showcase the effectiveness of integrating traditional culture with modern aesthetics

Spending on TV advertisements in China is declining as an overall share of advertising. By the end of 2019, Alibaba’s ad revenue is forecast to be 63% greater than total ad spending on TV. Nevertheless, TV advertising has its place in China and brands are getting smarter about using it to reach Chinese consumers with tactics such as product placements … even those that have humorous, but blatant promotion. The infographic below highlights some of the most effective strategies brands are using TV advertisements in China nowadays.

Fancy a tonic favoured by Chinese emperors that cures painful joints, frail kidneys, and weakness and anemia in women? Or how about a milk beverage that will enlarge your breasts from an A-cup to a D? Perhaps a coconut drink that whitens your skin and will make you more buxom?

A quick quiz to start this week's Skinny: What is the most valuable marketing company in the world? Most people probably couldn't care less, but there are a few folk in the industry who would say WPP. Whilst the company hasn't had a great year, it remains the largest marketing company in the world measured by billings and revenue.

In April 2016, pundits were predicting the demise of China’s cross border ecommerce channel after hefty new taxes were suddenly introduced on all online cross border trade. Fortunately, some slick lobbying from Alibaba and JD saw the new tax rates ‘postponed’ the following month and good old cross border was soon back on track.

Advertising on WeChat Moments can get your brand into Chinese consumers’ most personal of feeds, yet it is not cheap, with the CPM (cost per thousand impressions) north of $20 in bigger cities, with a 20% premium on short video ads.

Glance across any Chinese park, restaurant or subway and it becomes quite clear that online video is one of the most popular channels in China. It is also one of the most dynamic. This is reflected by user numbers which has seen former market leader Youku-Tudou’s 325 million active monthly mobile users fall far behind market leaders Tencent Video and iQiyi with 457 million and 442 million respectively.

When you are just one out of a heaving mass of 1.4 billion, feeling special or unique is a treasured experience not often received. As China’s cities swell and lives become increasingly homogenised brands are finding ways to make their consumers feel that unique touch.

For many Chinese, bicycles were for poor people and a cold or sweaty reminder of when few could afford a car and cities had no subways. In Beijing, just 12.5% of residents cycled in 2015, versus 38.5% in 2000.

An article in the Sydney Morning Herald last week highlighted some common misnomers about localisation and translation for China: After researching in China, an Australian vitamin brand found that their Mandarin-speaking Chief Science Officer would be most compelling speaking English in the brand's promotional videos for the Mainland market.

Keeping up with the dynamic Chinese consumer is essential for anyone selling in China, but it's also a good idea to stay abreast of ever-changing regulations. We obviously need to comply with the laws, but also understanding the regulations' nuances provides interesting insights into how Beijing wants to shape things, which affects almost every component of selling in China.

Many people, including some of the big media houses, still refer to China's population as 1.3 billion. This was true five years ago, but since 2012, the number of people living in China has been closer to 1.4 billion.

It is indisputable that Baidu is the dominant search engine in China. Although there are other search engines such as 360 and Sogou, their market share remains small compared to Baidu’s.

To make waves in the China market, you need more than just the right sales agreements and communications platforms. Having a China-optimised website, solid social media channels, and sales channels doesn’t necessarily mean consumers will come running. So, what will entice the ever-morphing Chinese consumer?

Few markets have experienced changes in the way that China has over the past few decades.

WeChat has taken China by storm. It is an important part of everyday life for the 550 million monthly active users who are largely Mainland residents, and a vital channel for millions of business accounts hoping to lure Chinese consumers to buy the wares.

With 55.2% of its 549 million monthly active users opening WeChat at least 10 times a day, the app is China’s most popular social network. Being perceived as the “Chinese Whatsapp”, WeChat offers far more features and many opportunities for brands to interact with their target market. Besides the regular user accounts, businesses can register official brand accounts to promote their products. Additionally, there are a number of functions that effectively support marketing to Chinese consumers. If you want to know more about how to effectively leverage those services, be in touch.

There's nothing quite like staying indoors for a couple of weeks to hone in on your gaming addiction. The coronavirus outbreak and resulting time people are spending inside their homes has seen a sharp increase in Chinese playing games. At the peak of the outbreak, Chinese were spending 6.11 billion hours a day online - over seven hours for each of China's 840 million online consumers.