Why China's white-collar workers are captivated by the simple, filling, and affordable 'Dry (干巴) Lunch'?

Recently, it seems everyone has been trying to make a British man's 'dry lunch (干巴饭).' It started when a woman from Northeast China shared a video on Douyin of her British husband making lunch. He slices two pieces of dry bread, spreads a bit of dry butter on them, which looks and sounds like plastering a wall. Then, he adds two slices of salmon fish and a handful of avocado and arugula/rocket, arranging it carefully on the plate. And just like that, a ‘fancy’ British lunch is ready.

'Dry lunch' uncle's account on Douyin (left) and his 'dry lunch.' Images: Douyin

He shares how to make 'dry lunch.' Images: Douyin

At first, some people questioned the dry lunch, asking, "Is this just bland white people food?" But after trying it repeatedly, they found themselves falling in love with it. They realized that the dry lunch perfectly meets the needs of workers for a simple, filling, and long-lasting meal, even helping with detox and weight loss.

Though it looks small, the dry lunch is actually packed with energy like a compressed biscuit, expanding in the stomach to satisfy hunger. Despite its plain appearance, it's a clean meal: whole grains promote digestion, leafy greens are full of fibre, and avocado and salmon provide high-quality fats. More and more young people are spontaneously joining the 'dry lunch club,' even creating their own slogan: Eat a dry lunch! Enjoy a dry life! (吃干巴lunch! 享干巴人生! )

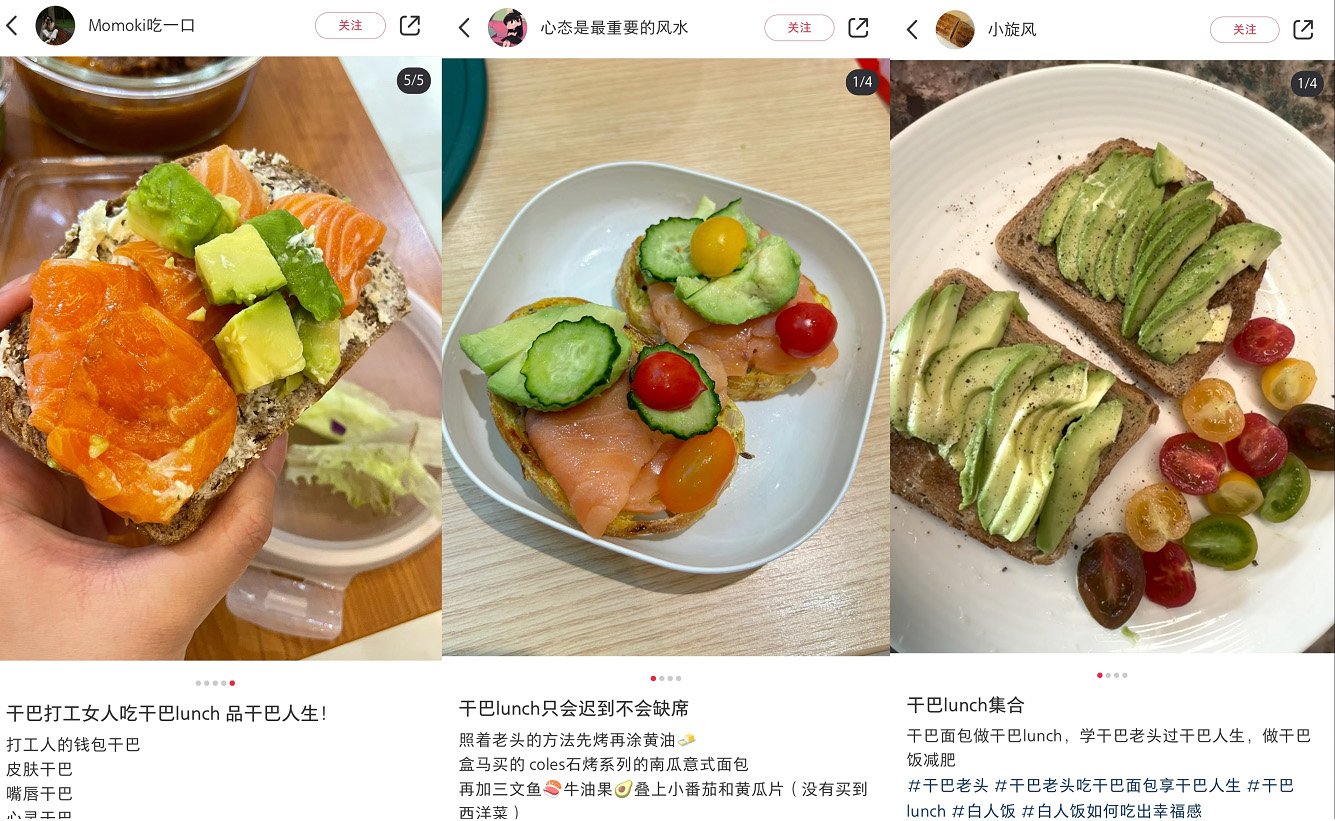

Many young people share their self-made 'dry lunch' on Xiaohongshu

Riding this trend, Hema/Freshippo launched its 'dry lunch' products. Images: Xiaohongshu

The popularity of the dry lunch isn't just because it’s simple, filling, and easy to make, but also because it’s cost-effective. Many people are realizing that simple and healthy eating is often overpriced. So-called 'healthy' light meals are usually expensive with exquisite presentation . After assessing pricey salad deliveries, savvy workers have realized that without the fancy presentation, a light meal’s salmon and avocado brunch is essentially just a prettier version of the dry lunch. With the endorsement of British tradition, how can you say this isn’t an authentic and affordable white-people brunch?

The light meal of FOODBOWL 超级碗 ranges from ¥28 to ($3.80)¥58 ($8) per person, more expensive than the easy homemade 'dry lunch' for a ordinary white collar worker. Images: Meituan

For dry lunch enthusiasts, this quick, simple, and healthy meal is the perfect eating solution. By simplifying their meals, they save time and energy, which they can then spend on other activities, all while staying happy and satisfied.

Despite foreign brands generally being perceived as safer in China, they often squander this advantage by failing to localise and understand the ecosystem and cultural nuances

Instead of chasing scale through aggressive franchising or racing to the bottom with price wars, Honeymoon and Ah-Ma Handmade are playing the long game: building brands rooted in culture, craftsmanship, and emotional connection

With local competitors mastering manufacturing efficiency and aggressive pricing, foreign brands have wrestled with the challenge to remain relevant without succumbing to the price war. Heytea provides some valuable lessons for maintaining premium positioning

Mixue is now the largest fast food chain in the world by stores. It hasn’t got there by following the Western outsourcing model, rather building on a structure that takes advantage of China’s unique infrastructure

Mixue has surpassed Starbucks and McDonald's to become the world's largest fast food chain. As the details illustrate, it wasn't by accident. The company's record-breaking IPO looks set to fund its next round of expansion

Blind boxes are redefining value, experience, and ethics in consumption. The intersection of affordability, gamification, and sustainability is a powerful formula that brands can learn from and adapt.

Despite being winter, Naimi's novel fried chicken-looking ice creams are flying out of the chiller. Their success provides many valuable lessons for brands selling in China

Photos of supermarkets like Sam’s Club being squeezed with throngs of shoppers in the CNY period

Hyper-local regional specialities are becoming increasingly popular in China based on their grassroots authenticity and uniqueness, presenting valuable lessons for foreign brands

A concise summary of last month's key marketing developments in China, highlighting valuable insights and their implications for brands.

China's coffee revolution is brewing. From Cotti Coffee's rapid rise to shifting cultural trends, discover why coffee could become China's next daily staple.

We’ve seen a number of companies in China back away from selling branded products to focus on selling commodities, parts or white labels. Based on the nature of the Chinese market, what is the best approach?

From adapting flavours to creating viral moments, Oreo has continually evolved to meet the changing tastes and lifestyles of Chinese consumers, transforming the foreign brand into a household favourite.

Blind boxes are trending in China. Supermarket blind boxes were one of the big sellers at this month's 11-11 shopping festival, with everything from beer to baby diapers mystery boxes popular. Here’s why it makes so much sense.

After spreading over social media, China’s youth have demonstrated their need for community and adventure en masse causing a stir on their 50km group ride

As Chinese consumers increasingly prioritize health and wellness, fresh milk and fruit tea brands are stepping up, with HEYTEA standing out prominently. This article explores HEYTEA's health-focused marketing strategies and provides insights for brands looking to cultivate health-oriented perceptions.

Although summer has come to an end in China, the enthusiasm for ice cups remains strong. Coffee ice cubes and fruit-flavoured ice ball cups have further encouraged people to explore DIY mixers and enhance their beverage experiences.

As new generations redefine what weddings look like, brands are seizing the moment to connect with young couples seeking authenticity and personalization.

China's consumer landscape is increasingly divergent. Lower-tier cities are rebounding faster and showing greater resilience than first- and second-tier cities. While large catering businesses struggle, smaller restaurants thrive. How can brands understand these diverging trends and their implications? Read on to find out more.

Corn-based coffee and drinks are trending in China, attracting wellness-focused consumers with their creative versatility, health appeal, and nostalgic flavours. Stable supply chains and regional pride further enhance their popularity, turning traditional corn into a modern beverage hit.

A number of high-end restaurants in China have closed or cut prices to stay afloat in the fierce dining market. However, we're seeing restaurants that blend dining with immersive experiences dining popular among young consumers, without lowering prices. Even without supply chain or scale advantages, these places are gaining a distinct competitive edge.

The wild Yunnan mushroom "Jian Shou Qing" went viral over summer. Despite its toxicity when undercooked, it's become a social media sensation and a trendy ingredient/flavour where the thrill and novelty, rather than taste, drive its popularity.

In mid-August, HEYTEA announced the launch of the "caffeine traffic light", disclosing the caffeine content of their fresh drinks. This approach helps consumers better manage their daily caffeine intake, raises the competitive standard within the milk tea industry and symbolises the need for personalisation to needs.

In China's new first-tier, second-tier, and third-tier cities, there's a craft beer chain called "Fu Lu Jia." The brand primarily targets the budget consumer market, with an operating model and pricing structure very similar to many tea drink brands in China. It has already opened over 130 locations. The evolution of craft beer poses some interesting questions about medium-term trends.

With the advancement of AI, many industries have successfully reduced costs and increased efficiency, and the food & beverage sector has seen the emergence of many innovative and data-driven products. However, are AI-developed foods really as good as we imagine yet?

In April, Lin Yuanchun birch water became the top-selling beverage on Douyin, surpassing brands like Coca-Cola and Oriental Leaf. Birch water continues to gain popularity, driven by its health benefits and the aggressive marketing on social media.

You can now book an at-home milk tea service! In Chengdu and Suzhou, some milk tea shops are launching this new service. What is driving the popularity of this new service?

Earlier this month, China's leading chain coffee brand, Luckin, launched a new crossover product called Light Jasmine milk tea. Due to its striking similarities with CHAGEE's signature product, bóyájuéxián, many netizens believe Luckin is essentially "replicating" it.

This summer, the combination of mint and chocolate has become a trending flavour in China following its popularity in other countries. Various brands are introducing mint chocolate-flavoured products in drinks, ice cream, bakery and cakes.

Size matters in the China market, but many foreign brands still miss the memo. Size preferences are notably different in China from Western markets across many categories, here are some reasons why...